The Legal Entity Identifier (LEI) is colloquially referred to as the LEI code or LEI number. It is a global identification code for businesses and other organisations, similar to a National Insurance number for individuals. The LEI is primarily used in financial contexts. Its purpose is to uniquely identify legal entities worldwide in a standardised manner.

| Preferred LOUs | 1-year / p.a. | 3-year / p.a. | 5-year / p.a. |

| EQS Group* | £75 | £65 | £55 |

| RapidLEI* | £50 | £40 | £35 |

| NordLEI | £85 (£69) | £65 (£59) | £59 (£55) |

EQS Group primarily collaborates with Registration Agents (RAs) to acquire customers. Their top-ranked RA is British LEI (https://britishlei.co.uk/). In reality, it is a company based in Estonia named “Baltic LEI AS”, with its headquarters in Tallinn, Estonia.

RapidLEI also partners with Registration Agents to acquire customers. Their leading RA is http://www.legalentityidentifier.co.uk, which is another Estonian company based in Tallinn named LEI Register OU. Notably, renewing you LEI with this provider costs more than the initial registration.

NordLEI (https://nordlei.org) is a Local Operating Unit that complies with GDPR and is certified under ISO 27001 for information security. It is headquartered in Stockholm, Sweden and the company is registered as “Nordic Legal Entity Identifier AB”. Renewing with the provider is cheaper than the initial registration.

How many LEIs do the LOUs manage in the UK?

| Name of LOU (Local Operating Unit) | Active LEIs |

| LONDON STOCK EXCHANGE LEI LIMITED (LSEG LEI) | 51,102 |

| Ubisecure Oy (RapidLEI) | 12,802 |

| Bloomberg Finance L.P. (Bloomberg LEI) | 6,700 |

| EQS Group AG | 3,374 |

| Herausgebergemeinschaft Wertpapier-Mitteilungen Keppler, Lehmann GmbH & Co. KG | 1,093 |

| The Irish Stock Exchange Public Limited Company | 448 |

| Unilei ApS | 198 |

| NordLEI | 196 |

| GS1 | 185 |

| Krajowy Depozyt Papierów Wartościowych S.A. | 91 |

What is a Legal Entity Identifier (LEI)?

The Legal Entity Identifier, often abbreviated to LEI, is usually referred to as “LEI code” or “LEI number” as mentioned earlier. They are unique, 20-character alphanumeric codes assigned to legal entities with the purpose of identifying them on the global financial market.

Just as a National Insurance number represents an individual, the LEI code represents a specific legal entity. One of the most significant characteristics of the LEI is its constant nature; the code does not change once it has been issued. This allows for clear and consistent identification over time.

This constant identification is crucial in a globalised economy where companies often trade across international borders. The LEI is comparable to a global company ID. Just as a National Insurance number provides specific information about an individual, the LEI code provides specific information about a legal entity, including details such as the company’s name, address, legal form, and any parent companies.

The LEI system is overseen by the Global Legal Entity Identifier Foundation (GLEIF), a non-profit organisation established by the Financial Stability Board (FSB) on behalf of the G20 countries in 2011. GLEIF ensures that each LEI code is unique, updated, and relevant. The first LEI codes were issued in 2012, marking the beginning of a new era of global business identification.

As a non-profit organisation, GLEIF ensures that:

- LEI meets one global standard.

- Each legal entity only has one unique LEI.

- The quality of underlying data is high.

- The LEI registry is open and accessible to all.

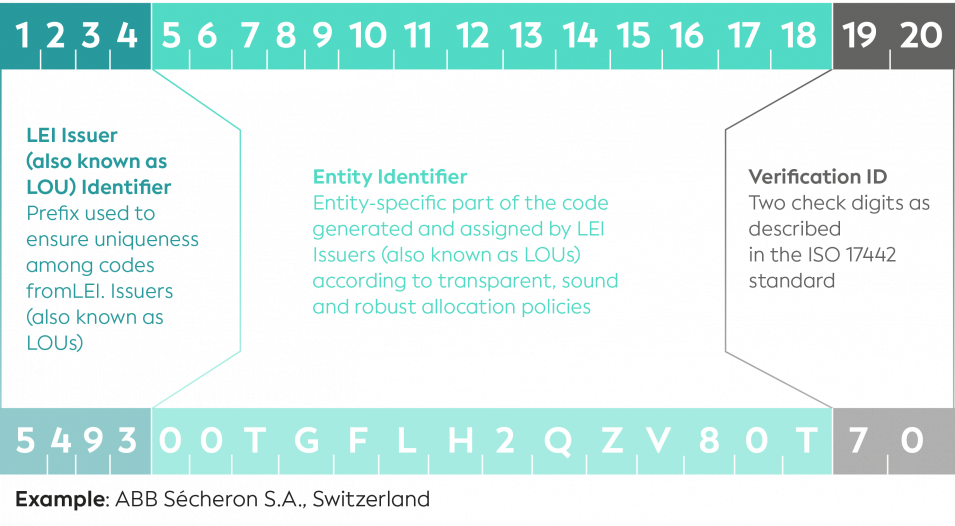

How is an LEI code structured?

- Characters 1–4: A unique prefix for each LEI issuer.

- Characters 5–18: A unique sequence for each legal entity, without embedded information.

- Characters 19–20: Check digits according to the ISO 17442 standard.

It’s also worth noting that the LEI code is based on the international standard ISO 17442. This standard ensures that LEI codes are consistent and reliable, no matter where in the world they are issued or used. An LEI code in Singapore has the same format as a UK LEI code.

What information can be identified with an LEI?

When an LEI is registered in the LEI database, it can be linked to important information about the legal entity. Examples include its official name, address, ownership structure, and other relevant details like the identification number in the UK or its international equivalent. This data is reviewed annually to ensure it remains current.

Read more about LEI, the ISO 17442 standard that defines the code at GLEIF’s site https://www.gleif.org/en/about-lei/iso-17442-the-lei-code-structure

The history behind LEI codes

In the aftermath of the global financial crisis of 2007-2008, it became clear that there was an urgent need to enhance transparency and traceability in the global financial market. Many financial institutions struggled to quickly identify parties in complex financial transactions, exacerbating the crisis. It was in this context that the idea of a global identifier for legal entities was conceived.

The G20 nations, convening to discuss solutions to the crisis, recognised the importance of having a uniform system to identify legal entities globally. They tasked the Financial Stability Board (FSB) with exploring the possibility of creating such an identifier. The FSB’s recommendations led to the establishment of the Global Legal Entity Identifier Foundation (GLEIF) in 2011.

GLEIF was mandated to oversee and implement the LEI system globally. With support from several international financial institutions and regulatory bodies, GLEIF began working on designing and launching the LEI system. The first LEI codes were subsequently issued in December 2012.

Since then, the LEI has become a central part of the global financial infrastructure. Hundreds of thousands of organisations worldwide now have an LEI code, underscoring its significance and acceptance in the global financial community. The system has not only improved transparency and efficiency in financial transactions but has also played a pivotal role in preventing future financial crises by providing regulators and market participants with the tools they need to better understand and manage risks.

GLEIF and its role

The Global Legal Entity Identifier Foundation (GLEIF) is at the heart of the LEI system. Established in 2011 at the behest of the G20 nations, GLEIF has since been responsible for overseeing and implementing the LEI system on a global scale.

As a non-profit organisation, GLEIF holds a unique position in the global financial landscape. They are not bound by commercial interests; instead, their primary focus is on maintaining the integrity and reliability of the LEI system. GLEIF ensures that LEI codes are issued based on the following principles:

- Global LEI Standard: By adhering to international standards, GLEIF guarantees that LEI codes are consistent and reliable worldwide.

- Uniqueness: Each legal entity is assigned only one LEI code, eliminating the risk of duplicates or confusions.

- High Data Quality: Through its LOUs (Local Operating Units), GLEIF monitors and verifies the quality of data associated with each LEI code, ensuring the information is always up-to-date and accurate.

- Open Access: The LEI registry is open to the public, meaning anyone can search and verify LEI codes at no cost.

Beyond these core principles, GLEIF works closely with its LOUs or LEI issuers. These organisations are responsible for issuing LEI codes to legal entities at the local level, while GLEIF ensures the entire process adheres to global standards. GLEIF has the authority to impose sanctions if an LOU fails to fulfil its duties appropriately.

Through its work, GLEIF contributes to creating a more transparent, reliable, and efficient global financial market. They play a pivotal role in shaping the future of corporate identification and help prevent the types of issues that contributed to the global financial crisis of 2007-2008.

GLEIF’s Legal Entity Identifier (LEI) is 506700GE1G29325QX363

The LEI Registry

The LEI Registry is the central database where all issued LEI codes and the associated details about legal entities are stored. The database serves as a global directory, accessible to everyone, providing information about participants in the global financial market.

Key aspects of the LEI Registry:

- Free Access: One of the most significant features of the LEI Registry is its openness. Anyone can freely search the registry and verify information about a legal entity using its LEI code. This promotes transparency and trust in the global economy.

- Data Quality: GLEIF ensures that the information in the LEI Registry is of high quality. Each entry is reviewed and updated regularly to ensure it is current and accurate.

- Structured Information: Beyond basic identification details like company name and address, the LEI Registry also contains detailed information about ownership relationships and corporate structures. This provides deeper insight into how legal entities are interconnected.

- Global Coverage: As LEI is a global standard, the registry contains information about legal entities from all over the world. Whether it’s a large multinational corporation or a smaller local entity, their details can be found in the LEI Registry.

The LEI Registry is more than just a database of legal entities. It’s a resource that enables better decision-making, risk management, and transparency for all parties in financial transactions. By granting everyone access to this information, the LEI Registry contributes to creating a more stable and reliable financial markets.

Who needs an LEI code?

Due to regulations, the LEI code has become a requirement in many parts of the world. In numerous countries, it’s not possible to trade securities without an LEI number. While the LEI system was originally created to address the needs within the financial sector, its use has expanded over time.

Here are some of the key situations where an LEI code is required:

Financial Institutions: Banks, insurance companies, investment funds, and other financial players need an LEI code to participate in certain types of financial transactions, especially those that are cross-border.

Securities Transactions: Organisations involved in securities trading, especially in international markets, require an LEI to ensure clear identification in transactions.

Derivative Trading: According to the EMIR regulation, sole traders need an LEI code if they trade in derivatives.

Regulatory Requirements: Many countries have introduced rules requiring certain types of legal entities to have an LEI code. For instance, within the EU, the LEI code became a requirement under the MiFID II/MiFIR regulations from 3 January 2018.

It’s important to note that LEI requirements can vary depending on jurisdiction and the type of business. While some organisations may need an LEI code due to specific regulatory requirements, others might choose to obtain one to benefit from the advantages that clear and consistent identification offers.

Considering the growing significance of the LEI code and its potential to extend to new areas, it’s wise for organisations to stay informed about the latest developments and requirements surrounding LEI.

GLEIF has a comprehensive list for the LEI requirements worldwide which can be found at https://www.gleif.org/en/lei-solutions/regulatory-use-of-the-lei.

LEI as a Global Standard for Identification

In a world where business transactions are becoming increasingly cross-border and complex, the need for a uniform and reliable method of identification has become ever more apparent. The LEI, or Legal Entity Identifier, has emerged as a solution.

Here are some key points highlighting the significance of LEI as a global standard:

Universal Acceptance: Regardless of where a legal entity is located in the world, the LEI provides a consistent and uniform method of identification. LEI numbers eliminate the confusion and uncertainty that can arise from using different identification systems in various countries.

Enhanced Transparency: With the LEI, stakeholders can easily verify and trace the identity of a legal entity. This is especially crucial in financial transactions where clear and accurate identification can prevent misunderstandings and errors.

Supports Regulation: Many regulatory authorities worldwide have adopted the LEI as part of their requirements. By doing so, they ensure that organisations operating within their jurisdiction can be reliably and consistently identified.

Based on ISO 17442: The LEI system is based on the international standard ISO 17442. This guarantees that LEI codes adhere to a globally accepted standard, further reinforcing its reliability.

Future Potential: While the LEI already plays a pivotal role in the financial sector, there’s potential for its use to expand to other sectors and applications. Considering the digital transformation and the growing importance of data-driven decision-making, the LEI could become even more crucial in the future.

In conclusion, the LEI represents more than just a code; it’s a cornerstone for a more interconnected, transparent, and reliable global economy.

LOU (Local Operating Units)

When discussing the LEI system, it’s crucial to understand the role that LOUs, or Local Operating Units, play within the LEI ecosystem. These units act as the bridge between legal entities requiring an LEI code and the global LEI system overseen by GLEIF.

Here are some key aspects of the function and significance of LOUs:

- Issuance of LEI Codes: The primary responsibility of LOUs is to issue LEI codes to legal entities. They manage the application process, verify the incoming information, and ensure that each new LEI code is unique and accurate.

- Updates and Renewals: To ensure that LEI data remains current and accurate, LOUs handle updates and renewals of LEI codes. This might involve updating company information or renewing an LEI code approaching its expiry date.

- Local Expertise: While LEI is a global standard, data is local. There are numerous local company registers that all need to be translated into an LEI standard. LOUs, often accredited for specific regions or countries, source this data from local registers and ensure the LEI process meets both global and local requirements.

- Quality Control: LOUs play a central role in maintaining the quality of LEI data. They conduct regular checks and audits to ensure the information in the LEI registry is accurate and up-to-date.

- Collaboration with GLEIF: Even though LOUs operate at the local level, they work closely with GLEIF to ensure the LEI system operates smoothly and efficiently. This collaboration is vital for maintaining the integrity and reliability of the LEI system.

In short, LOUs act as the operational arms of the LEI ecosystem. They handle the day-to-day administration of LEI codes and ensure the system operates effectively at the local level while adhering to the global standards set by GLEIF.

Look for the GLEIF Accredited seal when you register your LEI.

Use-cases of the LEI number

The LEI code was originally created to address specific needs within the financial sector. Its ability to provide a unique and reliable identification of legal entities has made it an invaluable resource in many other contexts.

Here are some of the most prominent applications of the LEI code:

Financial Transactions: The LEI code is crucial for identifying parties in complex financial transactions, especially in situations where multiple parties from different countries are involved.

Regulatory Reporting: Many regulatory bodies now require companies to use LEI codes in their reports. This assists the authorities in quickly and accurately identifying the reporting entities and understanding their relationships with other entities.

Risk Management: Companies use LEI codes to better understand and manage risks associated with their business partners. By being able to trace an entity’s history and relationships, companies can make more informed decisions.

Supply Chain Management: In complex supply chains, LEI codes can help companies identify and verify their suppliers, reducing the risk of fraud and improving efficiency.

Verifiable LEI: With the introduction of the verifiable LEI, or vLEI, there’s potential for the LEI to be used in digital identity solutions. Once implemented, it could revolutionise how individuals associated with legal entities are identified in digital transactions.

International Trade: For companies engaged in cross-border trade, LEI codes can streamline the process by providing clear identification of all involved parties.

It’s important to note that while these are some of the current applications of the LEI code, its potential continues to grow. With the ongoing evolution of global markets and technologies, we can expect to see the LEI code used in even more contexts in the future.

Frequently Asked Questions

What is a Legal Entity Identifier (LEI)

A Legal Entity Identifier (LEI) is a 20-character alphanumeric code used to identify legal entities globally. Each LEI number is unique and exclusive: it is assigned to a company once and cannot be assigned to any other company.

Who needs to get an LEI?

Since 3 January 2018, legal entities must have a Legal Entity Identifier if they conduct financial transactions on a regulated market in accordance with MiFID II/MiFIR.

How long does it take to get an LEI?

NordLEI typically assigns a Legal Entity Identifier (LEI) number within 2 hours of receiving payment. EQS and RapidLEI are a bit slower.

Why was the LEI system created?

The Legal Entity Identifier (LEI) was created following the global financial crisis of 2008 to help establish and maintain a global standard for uniquely identifying legal entities participating in financial transactions

How long is an LEI valid for?

Once issued, a Legal Entity Identifier (LEI) is valid for one year. If you have chosen to purchase multiple years at once, your LEI code will automatically be renewed.

Is my LEI valid globally?

A Legal Entity Identifier (LEI) is a universal, public identifier that is valid across all jurisdictions globally.

What information is contained in an LEI number?

The LEI database is public. It contains information about legal entities, such as their name, address, ownership structure, and other details that help identify entities and their relationships with other organisations. It also includes information about the issuer of the LEI and the status of the LEI.

What is vLEI?

vLEI, or Verifiable Legal Entity Identifier, is a part of the broader Legal Entity Identifier (LEI) system. It’s designed to provide organizations with a verifiable digital identity on a global scale. Read more about vLEI at https://vlei.com

Last reviewed: 2024-12-01